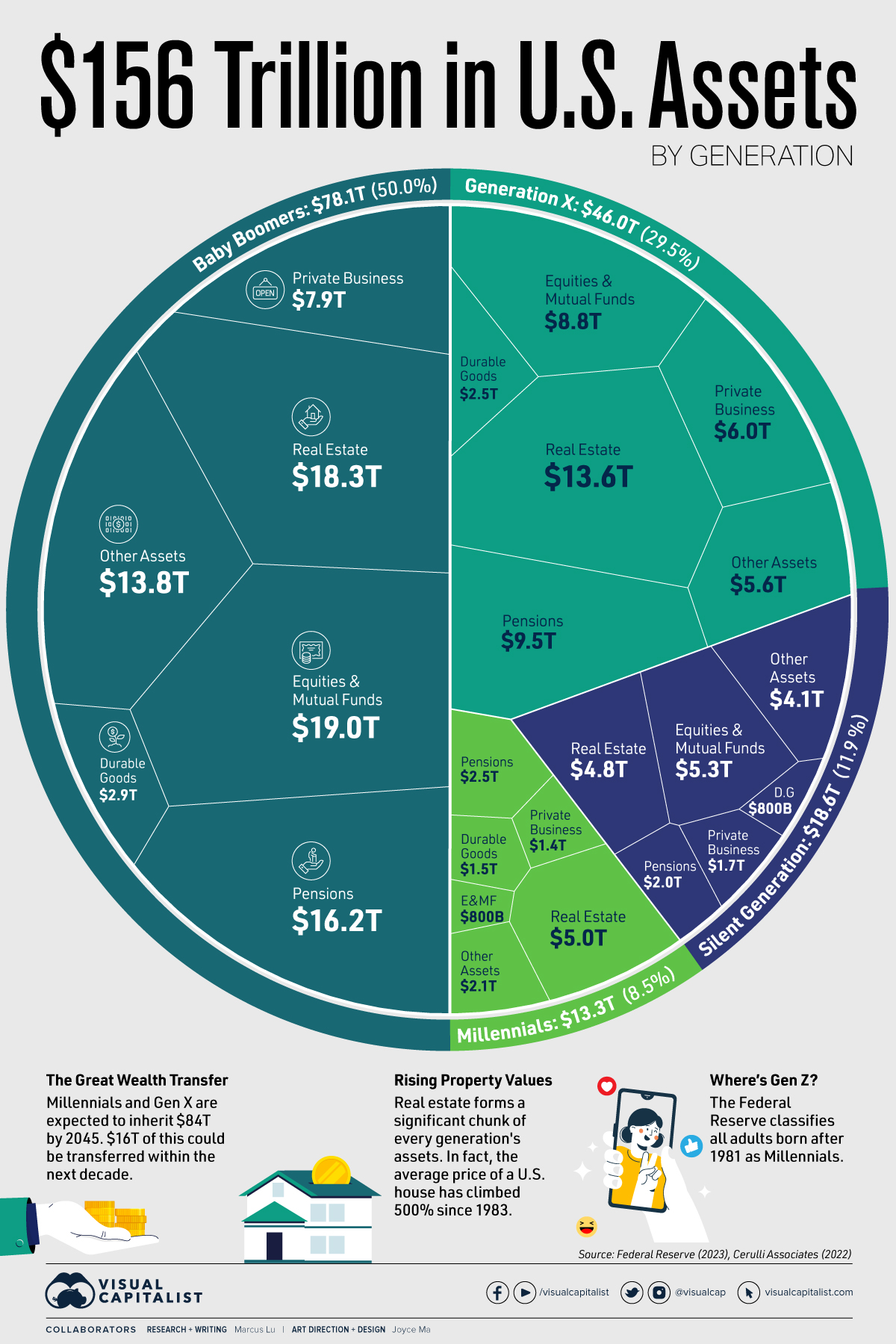

Wealth by generation and asset class:

#3

The one question Iíve never been able to get answered is ďwhatís my number?Ē What number am I shooting for in my retirement accounts so that I know when I can retire?

That question is always answered with more questions. More is better of course, but Iíd sure like to know when I can pull the chute and be done.

That question is always answered with more questions. More is better of course, but Iíd sure like to know when I can pull the chute and be done.

#4

The one question I’ve never been able to get answered is “what’s my number?” What number am I shooting for in my retirement accounts so that I know when I can retire?

That question is always answered with more questions. More is better of course, but I’d sure like to know when I can pull the chute and be done.

That question is always answered with more questions. More is better of course, but I’d sure like to know when I can pull the chute and be done.

https://www.irs.gov/retirement-plans...2031%2C%202022).

ROUGh approximation is being able to live on 3% of your investment earnings until age 72 and 4% (increasing constantly as you age) thereafter. So if you retire at 65 with $5 million in investments plan on getting by on $150k a year until age 65. Pensions and medical coverage from a previous career (ie., retired military) obviously can seriously alter that number of course.

#5

ROUGH rule of thumb is to have enough in investments to be able to live on the Required Minimum Distribution percentage you have for an IRA or 401k and everything your investments earn above that would be reinvested.

https://www.irs.gov/retirement-plans...2031%2C%202022).

ROUGh approximation is being able to live on 3% of your investment earnings until age 72 and 4% (increasing constantly as you age) thereafter. So if you retire at 65 with $5 million in investments plan on getting by on $150k a year until age 65. Pensions and medical coverage from a previous career (ie., retired military) obviously can seriously alter that number of course.

https://www.irs.gov/retirement-plans...2031%2C%202022).

ROUGh approximation is being able to live on 3% of your investment earnings until age 72 and 4% (increasing constantly as you age) thereafter. So if you retire at 65 with $5 million in investments plan on getting by on $150k a year until age 65. Pensions and medical coverage from a previous career (ie., retired military) obviously can seriously alter that number of course.

#6

The one question I’ve never been able to get answered is “what’s my number?” What number am I shooting for in my retirement accounts so that I know when I can retire?

That question is always answered with more questions. More is better of course, but I’d sure like to know when I can pull the chute and be done.

That question is always answered with more questions. More is better of course, but I’d sure like to know when I can pull the chute and be done.

How much social security are you planning on?

Do you have any medical benefits such as tricare?

Do you have any outside income sources (pensions, rentals, etc).

At what age do you plan to retire?

How long do you expect to live? Trick question, but current health and family history matters. If you might eb at risk for not living very long, it might make sense to live it up while you can, and accept that risk that if you live longer you'll have a more modest lifestyle. Not too unreasonable, since most people travel less and are less active as they get older.

Most pilots should assume 90-ish lifespan, unless you have specific reasons to believe otherwise.

Given that info, it's very easy to calculate a conventional-wisdom portfolio requirement. Excargo threw out $5M, that's probably a good comfortable starting point if you have no outside income sources.

#7

#8

Spending more violates the rules for wise philanthropy. You risk running out of money, in the long run.

#10

https://www.irs.gov/retirement-plans...ibution-limits

Thread

Thread Starter

Forum

Replies

Last Post