Easter Meltdown

#171

AAL had a large debt load prior to Covid19. After some research it looks like they are continuing that plan going forward and adding to it. The plan to use the cash store from increased debt to fund airplanes and operations. SWA and DAL plan to pay off the new debt and are able to use cash for airplanes. The relative debt load is the largest disparity between the companies.

AALs new bonds yield 5+% so investors in bonds have taken a heavy stake in the company which devalues equity. $6.5B in new bonds and $3.5B in new loans and a total debt load of $50B. They pushed out the maturities to try and take full advantage of the impending recovery and growth. They are making a much higher stakes bet on the return of air travel than DAL. DAL bonds are yielding 3ish% and are more linear in maturities. AAL has added $550M in annual interest payments while all indications for DAL is an aggressive debt pay down after cash neutral is no longer the objective.

That strategy at DAL means low profit sharing payouts short term and huge amounts in a few years. Low payouts relative to our high water mark, but in line with UAL. This situation will seem like a good reason to sell profit sharing but it will be hugely back loaded giving management a window to negotiate it away with a relatively quick TA. This works well for DALs resumption of sect. 6 as they will point to no and then low profit sharing payouts for 2020 and 2021 in an effort to take it back. There will be an appetite for a new deal when things turn around and I think the MEC chair will be motivated to deal to get something done which also will help management. The pilot group will also be impatient and hopefully won’t overlook the mounting profit margins as we go forward.

Morgan Stanley also sees the 2-3 year horizon for DAL and will ratchet up their target. DAL management laid the ground work for a ~ $100 target prior to Covid19. See the previous investor presentations on delta.com.

https://www.wsj.com/amp/articles/american-airlines-joins-debt-market-behemoths-11615973407

AALs new bonds yield 5+% so investors in bonds have taken a heavy stake in the company which devalues equity. $6.5B in new bonds and $3.5B in new loans and a total debt load of $50B. They pushed out the maturities to try and take full advantage of the impending recovery and growth. They are making a much higher stakes bet on the return of air travel than DAL. DAL bonds are yielding 3ish% and are more linear in maturities. AAL has added $550M in annual interest payments while all indications for DAL is an aggressive debt pay down after cash neutral is no longer the objective.

That strategy at DAL means low profit sharing payouts short term and huge amounts in a few years. Low payouts relative to our high water mark, but in line with UAL. This situation will seem like a good reason to sell profit sharing but it will be hugely back loaded giving management a window to negotiate it away with a relatively quick TA. This works well for DALs resumption of sect. 6 as they will point to no and then low profit sharing payouts for 2020 and 2021 in an effort to take it back. There will be an appetite for a new deal when things turn around and I think the MEC chair will be motivated to deal to get something done which also will help management. The pilot group will also be impatient and hopefully won’t overlook the mounting profit margins as we go forward.

Morgan Stanley also sees the 2-3 year horizon for DAL and will ratchet up their target. DAL management laid the ground work for a ~ $100 target prior to Covid19. See the previous investor presentations on delta.com.

https://www.wsj.com/amp/articles/american-airlines-joins-debt-market-behemoths-11615973407

Sent from my SM-N986U using Tapatalk

#172

Gets Weekends Off

Joined APC: Aug 2011

Position: Hoping for any position

Posts: 2,529

To quote POTUS: "Come on man!"

I am not an affected pilot nor did I ever convert to UNA.....I've been waiting for a SRQ since end of Dec 2020....public school maths says that was 4 months ago.

How many guys/gals are waiting 30+ days for OE?

This meltdown was 100% not because a few employees scheduled a vaccine shot over easter weekend....it's because Flt Ops "leadership" has been making terrible manning decisions for the last 6-9 months!

I am not an affected pilot nor did I ever convert to UNA.....I've been waiting for a SRQ since end of Dec 2020....public school maths says that was 4 months ago.

How many guys/gals are waiting 30+ days for OE?

This meltdown was 100% not because a few employees scheduled a vaccine shot over easter weekend....it's because Flt Ops "leadership" has been making terrible manning decisions for the last 6-9 months!

Time for the union to do its job and publish the facts of how many are sitting NQAT, awaiting OE or any other reason they are not working. These were all avoidable had we followed a similar sequence of events that SW did in terms of employee leaves and early retirements PRIOR to displacements. What caused the thanksgiving meltdown? Must have been those terrible pilots getting secretly vaccinated then too.

#173

Gets Weekends Off

Joined APC: Jun 2015

Posts: 1,778

Lower interest payments yes, but PTIX is lower when you pay down principal.

#174

#175

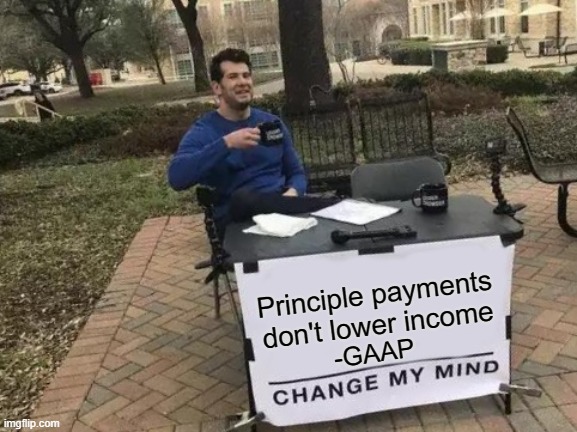

My reading of the PWA and understanding of GAAP leads to a different conclusion.

PTIX = Pre-tax income based on GAAP -PWA Section 2 216

Principle payments do not lower taxable income according to GAAP.

#176

Gets Weekends Off

Joined APC: Oct 2020

Posts: 560

Time for the union to do its job and publish the facts of how many are sitting NQAT, awaiting OE or any other reason they are not working. These were all avoidable had we followed a similar sequence of events that SW did in terms of employee leaves and early retirements PRIOR to displacements. What caused the thanksgiving meltdown? Must have been those terrible pilots getting secretly vaccinated then too.

I’d also be curious to know how many of us were to blame for Christmas AND Thanksgiving meltdowns. Having said that, I do fully expect many will have shots July 1/2 with a trip starting on July 2/3. There’s two months to get NQAT guys online. Many just need their 4 sim sessions and return to their old equipment.

I’m most interested to see how we handle our newly divided airline and the associated seniority lists.

https://twitter.com/TheDailyShow/status/1379445621741006857?s=20

#177

Gets Weekends Off

Joined APC: Aug 2015

Posts: 556

No kidding on the cab ride to the airport had an FA announce to the rest of us that she watched some town hall yesterday. Her recollection was that this was out of the companies hands and they couldn’t do anything to prevent it. And that it was caused by pilots calling in because of vaccines. She was quickly shot down.

Time for the union to do its job and publish the facts of how many are sitting NQAT, awaiting OE or any other reason they are not working. These were all avoidable had we followed a similar sequence of events that SW did in terms of employee leaves and early retirements PRIOR to displacements. What caused the thanksgiving meltdown? Must have been those terrible pilots getting secretly vaccinated then too.

Time for the union to do its job and publish the facts of how many are sitting NQAT, awaiting OE or any other reason they are not working. These were all avoidable had we followed a similar sequence of events that SW did in terms of employee leaves and early retirements PRIOR to displacements. What caused the thanksgiving meltdown? Must have been those terrible pilots getting secretly vaccinated then too.

#178

Gets Weekends Off

Joined APC: Apr 2016

Position: Looking left

Posts: 3,418

And I'm sure the hundreds...mayby even thousands of pilots sitting NQAT for months, or waiting 30+ days for OE had nothing to do with it.

#179

Gets Weekends Off

Joined APC: Jul 2010

Position: window seat

Posts: 12,544

That ship has sailed. I don't think one penny in lower PS or a single additional large RJ is even entertained at the table. If anything, low PS paypout is the perfect time to get incresed PS going forward. A return to the C2012 threshold for first tier plus a substantial additional percentage of any future shareholder burnkacks on top of that is a very reasonable ask; it only comes into play if there's massive profits and they can be afforded in the first place...

#180

That ship has sailed. I don't think one penny in lower PS or a single additional large RJ is even entertained at the table. If anything, low PS paypout is the perfect time to get incresed PS going forward. A return to the C2012 threshold for first tier plus a substantial additional percentage of any future shareholder burnkacks on top of that is a very reasonable ask; it only comes into play if there's massive profits and they can be afforded in the first place...

Thread

Thread Starter

Forum

Replies

Last Post