Thoughts on Bailouts?

#51

Super Moderator

Joined APC: Dec 2007

Position: DAL 330

Posts: 6,868

Dobbs,

Im not mgmt and it's almost impossible to structure a company to survive no to little revenue fro 1-6months. Your proposal to just stockpile Billions and Billions of profits in cash accounts is not something that capitalist companies do. They have a BOD who manage the company to make as much profit as possible. If they have extra they can reinvest in stuff, grow, pay people more, increase a dividend or buy back shares in the company. The mgmt and BOD have to decide the best use of the money and each has positives and negatives. Because certain companies refuse to repatriate their profits from other countries (like Apple etc) and have huge cash balances outside the US, that is a function of the US tax code and not good corporate governance.

Im not mgmt and it's almost impossible to structure a company to survive no to little revenue fro 1-6months. Your proposal to just stockpile Billions and Billions of profits in cash accounts is not something that capitalist companies do. They have a BOD who manage the company to make as much profit as possible. If they have extra they can reinvest in stuff, grow, pay people more, increase a dividend or buy back shares in the company. The mgmt and BOD have to decide the best use of the money and each has positives and negatives. Because certain companies refuse to repatriate their profits from other countries (like Apple etc) and have huge cash balances outside the US, that is a function of the US tax code and not good corporate governance.

I agree with you its a little more complicated then just hoarding cash but what would be wrong with just running a more fiscally conservative company. Almost every airline management team follows the same playbook - so why are they being compensated like they are invaluable? If every major airline rises and falls with the market then our executive teams do not merit their extraordinary compensation.

What about paying cash for aircraft when profiting in the billions? Maybe spending $7 billion on buybacks vs $15 billion. And finally, in my airlines case (Delta) not borrowing money to buy back your stock. Not sure if any other management team was arrogant enough to do that but it wouldn't surprise me.

Scoop

#52

Gets Weekends Off

Joined APC: Mar 2014

Posts: 3,097

I agree with you its a little more complicated then just hoarding cash but what would be wrong with just running a more fiscally conservative company. Almost every airline management team follows the same playbook - so why are they being compensated like they are invaluable? If every major airline rises and falls with the market then our executive teams do not merit their extraordinary compensation.

What about paying cash for aircraft when profiting in the billions? Maybe spending $7 billion on buybacks vs $15 billion. And finally, in my airlines case (Delta) not borrowing money to buy back your stock. Not sure if any other management team was arrogant enough to do that but it wouldn't surprise me.

Scoop

What about paying cash for aircraft when profiting in the billions? Maybe spending $7 billion on buybacks vs $15 billion. And finally, in my airlines case (Delta) not borrowing money to buy back your stock. Not sure if any other management team was arrogant enough to do that but it wouldn't surprise me.

Scoop

I think the point of running a conservative company is so if something like this happens, you are the last one standing and can rebuild.

The magnitude of the effects of essentially shutting down 70% of the economy for several months still hasn't hit home to many. Honestly, I'm personally scared. Not for me personally but for society as a whole and where this will lead. And what about the after effects? We are shedding several times more the amount of jobs in the 2008-2009 recession and are only a week into this.

Imagine 9/11, 2008, and age 65 rolled into one. That might approach what is happening today.

#53

Super Moderator

Joined APC: Dec 2007

Position: DAL 330

Posts: 6,868

Sometimes there are just events that companies cannot overcome. So they go out of business. Sometimes entire industries go out of business. If we didn't bail any airline out, I guarantee there would still be Boeings flying in six months between major cities, and slowly regional carriers would start to pick up the smaller cities. It would basically be a rebuild of what we have, just less aircraft.

I think the point of running a conservative company is so if something like this happens, you are the last one standing and can rebuild.

The magnitude of the effects of essentially shutting down 70% of the economy for several months still hasn't hit home to many. Honestly, I'm personally scared. Not for me personally but for society as a whole and where this will lead. And what about the after effects? We are shedding several times more the amount of jobs in the 2008-2009 recession and are only a week into this.

Imagine 9/11, 2008, and age 65 rolled into one. That might approach what is happening today.

I think the point of running a conservative company is so if something like this happens, you are the last one standing and can rebuild.

The magnitude of the effects of essentially shutting down 70% of the economy for several months still hasn't hit home to many. Honestly, I'm personally scared. Not for me personally but for society as a whole and where this will lead. And what about the after effects? We are shedding several times more the amount of jobs in the 2008-2009 recession and are only a week into this.

Imagine 9/11, 2008, and age 65 rolled into one. That might approach what is happening today.

Scoop

Last edited by Scoop; 03-20-2020 at 12:28 PM.

#54

I agree with you its a little more complicated then just hoarding cash but what would be wrong with just running a more fiscally conservative company. Almost every airline management team follows the same playbook - so why are they being compensated like they are invaluable? If every major airline rises and falls with the market then our executive teams do not merit their extraordinary compensation.

What about paying cash for aircraft when profiting in the billions? Maybe spending $7 billion on buybacks vs $15 billion. And finally, in my airlines case (Delta) not borrowing money to buy back your stock. Not sure if any other management team was arrogant enough to do that but it wouldn't surprise me.

Scoop

What about paying cash for aircraft when profiting in the billions? Maybe spending $7 billion on buybacks vs $15 billion. And finally, in my airlines case (Delta) not borrowing money to buy back your stock. Not sure if any other management team was arrogant enough to do that but it wouldn't surprise me.

Scoop

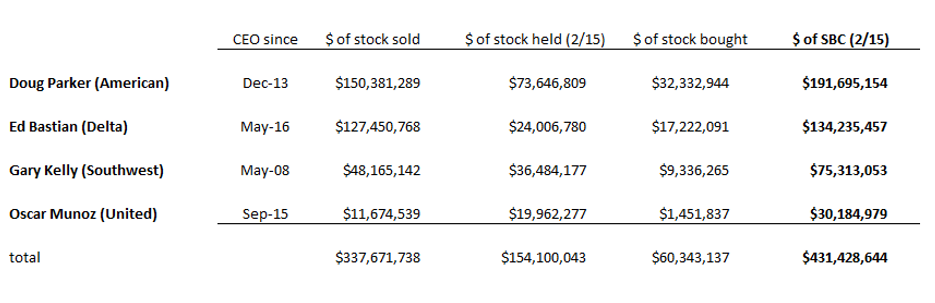

Airline Free Cash Flow and Buyback Matrix 2020.

Here’s your answer Scoop. AA had NEGATIVE free cash flow of 7.9 billion in the last 10yrs, during which time they executed 12.9 billion dollars of buybacks. So they were going into deeper debt during the same time they were buying back stock to inflate their share price.

If I were an AA pilot, I would have some hard feelings about Doug P & Co.

An interest free government loan isn’t going to be enough for AA to continue on its usual business. AA needs grant (free) money. I know some guys that are going to get hurt really bad by their management’s selfish leadership.

#55

Gets Weekends Off

Joined APC: Nov 2019

Posts: 1,256

Interesting article

https://www.dallasnews.com/business/...eds-a-bailout/

https://www.dallasnews.com/business/...eds-a-bailout/

“I don’t want to have stock buybacks,” Trump said Friday. “I don’t want some executive saying we are going to buy 200,000 shares of stocks. I want that money for the workers and also for the company, to keep the company going.”

#56

Airline Free Cash Flow and Buyback Matrix 2020.

Here’s your answer Scoop. AA had NEGATIVE free cash flow of 7.9 billion in the last 10yrs, during which time they executed 12.9 billion dollars of buybacks. So they were going into deeper debt during the same time they were buying back stock to inflate their share price.

If I were an AA pilot, I would want to string up Dougweiser and let the employees flog him in the front lobby of their shiny new HQ.

An interest free government loan isn’t going to be enough for AA to continue on its usual business. AA needs grant (free) money. I know some guys that are going to get hurt really bad by their management’s selfish leadership.

Here’s your answer Scoop. AA had NEGATIVE free cash flow of 7.9 billion in the last 10yrs, during which time they executed 12.9 billion dollars of buybacks. So they were going into deeper debt during the same time they were buying back stock to inflate their share price.

If I were an AA pilot, I would want to string up Dougweiser and let the employees flog him in the front lobby of their shiny new HQ.

An interest free government loan isn’t going to be enough for AA to continue on its usual business. AA needs grant (free) money. I know some guys that are going to get hurt really bad by their management’s selfish leadership.

#57

Last time, when the banks were collapsing into themselves, they were getting told to merge with others, or go out of business.

Dont be surprised to see some forced marriages of the weakest carriers into others. You could easily see JBlue, Alaska and others get forced marriages with larger carriers as a requirement of a bailout. It could get that bad.

Dont be surprised to see some forced marriages of the weakest carriers into others. You could easily see JBlue, Alaska and others get forced marriages with larger carriers as a requirement of a bailout. It could get that bad.

#58

Gets Weekends Off

Joined APC: Dec 2005

Posts: 8,898

Still can't believe Doug Parker said in 2017 that American would never lose money in the future.

It's the airline industry. You're going to have "events" that will critically injure your financial status. This time it's COVID19.

It's the airline industry. You're going to have "events" that will critically injure your financial status. This time it's COVID19.

#59

Gets Weekends Off

Joined APC: Mar 2014

Posts: 3,097

JetBlue and Alaska are smaller, but they are not weaker than the larger carriers. A forced merger may not go the way you think it will. It doesn’t matter, it’s a non-starter. There is strong bipartisan support for loans and only for grants that have significant guardrails to include prohibiting stock buybacks, bankruptcy protections for labor baked into the deal (you don’t get to take the money and the use bankruptcy to discharge your obligations as was done before), limits on executive compensation for a term of years, and labor seats on Boards of Directors to list a few of the guardrails.

The legacies large widebody fleet is a huge hindrance to their recovery, unless shed quickly in a bankruptcy.

#60

Exactly!!! And to think some pilots(initially) considered that a noble venture to curtail their wages (some just cut a percentage) for a few months. Employees will feel the impact, they will most certainly not.

*****Nothing to see here folks, nothing to see, move along, move along...***** Heck, make some quick cuts to ourselves, cut the fat, cut some wages down, offer this, offer that, the employees will be happy and grateful to keep a job at reduced rates/time off and we’ll be sitting pretty to get our bailout showing “We tried Very Hard!” Meanwhile, if they cut more than a year of salary, they wouldn’t even feel it for more than a decade, if ever...

When provided the cash (Bailout), they ALL must be carefully monitored to ensure it gets to their work force and only operating requirements. Not to ensure full income, but survivable means whatever that entails. Beyond my opinion of course.

Definitely regulate the Bailout cash to true operating requirements, and none of it should ever go to stock buybacks, etc. Bailing out a masking of true value.

It doesn’t matter, but my initial thoughts were it’s a loan to survive an unforeseen natural disaster, but now - definitely in my eyes a bailout to mitigate when sound minds were not at the helm as history has proven over and over again. Understandably as mentioned by folks before, it’s not a business mindset to hoard tons of cash aside and not reinvest into the company in some form, but why are the masses advised to save 6 months of earnings (required amount) for that rainy day. They didn’t, why should you and yet here we are again. Never makes sense for some until your in that forced position.

Interesting “Raccoon” article posted earlier, but the pax industry shouldn’t be declared as vital as electricity, let alone healthcare or the sketchy banking system (which always needs adjusting). Just collapse them in your mind and logically consider the impacts of any single one of them or God forbid all of them (your witnessing healthcare pressure now on a medium scale, banking in 08 and we’ve all had the power out some longer than others). Transportation service maybe, a utility perhaps; either way, the carriers are super important and make life incredibly efficient, effective and leisurely if you will (especially for a virus) - but if the nation were impacted at 50% or greater loss regarding electricity, healthcare and banking if it were catastrophic, lives would be lost exponentially.

*****Nothing to see here folks, nothing to see, move along, move along...***** Heck, make some quick cuts to ourselves, cut the fat, cut some wages down, offer this, offer that, the employees will be happy and grateful to keep a job at reduced rates/time off and we’ll be sitting pretty to get our bailout showing “We tried Very Hard!” Meanwhile, if they cut more than a year of salary, they wouldn’t even feel it for more than a decade, if ever...

When provided the cash (Bailout), they ALL must be carefully monitored to ensure it gets to their work force and only operating requirements. Not to ensure full income, but survivable means whatever that entails. Beyond my opinion of course.

Definitely regulate the Bailout cash to true operating requirements, and none of it should ever go to stock buybacks, etc. Bailing out a masking of true value.

It doesn’t matter, but my initial thoughts were it’s a loan to survive an unforeseen natural disaster, but now - definitely in my eyes a bailout to mitigate when sound minds were not at the helm as history has proven over and over again. Understandably as mentioned by folks before, it’s not a business mindset to hoard tons of cash aside and not reinvest into the company in some form, but why are the masses advised to save 6 months of earnings (required amount) for that rainy day. They didn’t, why should you and yet here we are again. Never makes sense for some until your in that forced position.

Interesting “Raccoon” article posted earlier, but the pax industry shouldn’t be declared as vital as electricity, let alone healthcare or the sketchy banking system (which always needs adjusting). Just collapse them in your mind and logically consider the impacts of any single one of them or God forbid all of them (your witnessing healthcare pressure now on a medium scale, banking in 08 and we’ve all had the power out some longer than others). Transportation service maybe, a utility perhaps; either way, the carriers are super important and make life incredibly efficient, effective and leisurely if you will (especially for a virus) - but if the nation were impacted at 50% or greater loss regarding electricity, healthcare and banking if it were catastrophic, lives would be lost exponentially.

Thread

Thread Starter

Forum

Replies

Last Post

vagabond

Hangar Talk

14

04-25-2007 09:09 AM