April Adjustment Entitlement (AE)

#41

Line Holder

Joined APC: Mar 2019

Posts: 71

I'm not a finance guy, but I have a real question. If the Delta shares outstanding is roughly 650M and Delt stock sells for $20/share, could somebody buy 51% of those shares for about 6.5 B $$, then vote to liquidate the company cause they have controlling intrest? They spend 6.5B for 15B cash and all the assets? Other than legal ramifications, is that correct?

https://www.marketwatch.com/story/spirit-airlines-adopts-poison-pill-to-be-exercisable-if-an-investor-acquires-10-of-the-shares-outstanding-2020-03-30

#42

Gets Weekends Off

Joined APC: Jul 2010

Position: window seat

Posts: 12,522

Impossible. All business geniuses know that you must always be vulnerable to hostile takeovers, just because. The only defense is an intentionally weakened balance sheet. That's why Spirit and Southwest went out of business a long time ago. Also there's no money in cargo.

#43

If you divide our share holders equity by the number of outstanding common shares from the 10K, each share is worth roughly $24. Delta would have to trade at a level significantly below that to extract value by dismantling. Our large share holders, Berkshire, Vanguard, PRIMEcap, Blackrock, and all the other mutual funds holding a significant amount would have to either sell or be in on it. I donít see this as likely.

#46

Can't abide NAI

Joined APC: Jun 2007

Position: Douglas Aerospace post production Flight Test & Work Around Engineering bulletin dissembler

Posts: 11,989

Watch Crew Planning on SkyNet. My recall was that Bob said that a cross divisional team is working on a fleet plan. He will take that fleet plan and staff the airline. He seemed to indicate that he would have the plan in four to six weeks.

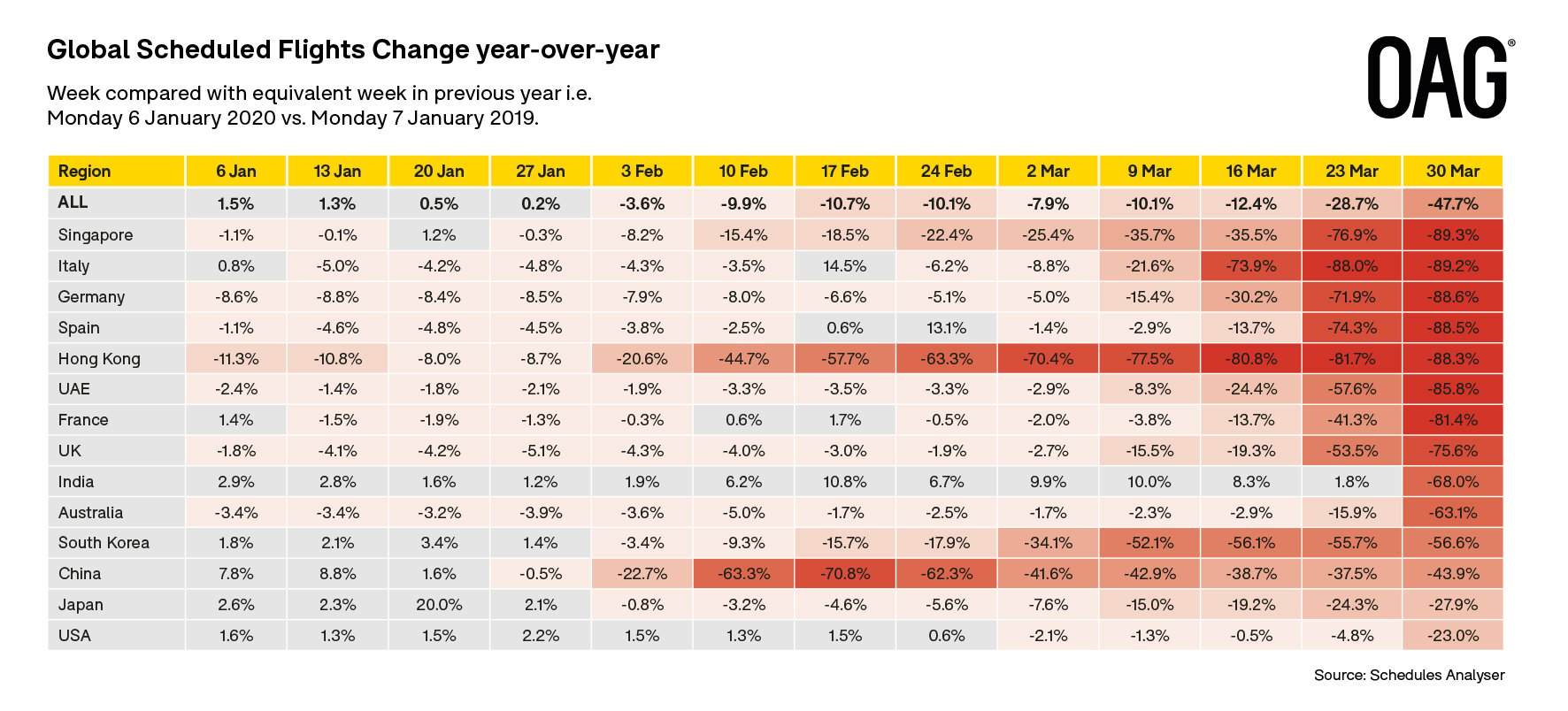

It would seem we have until Oct 1 to really figure it out. Since the plan is constantly changing (currently getting worse) we and the company probably benefit by being slower to react. Believe it or not, we are the best market in the world, based on the current (3/30) schedule load. China tried to rebound, then sank again by 5% last week. These numbers are truly terrible. These must get better before the bid.

These numbers are truly terrible. These must get better before the bid.

Usually, the industry follows GDP pretty closely. This may be considerably different. I am still hanging on to Ed's prognosis of an airline that is 70% of what Delta was, but that is appearing to be optimistic. If we are 65%, that is the size of Delta before the NWA merger.

What is going to be curious is what the bottom looks like without many T Tails in the fleet. I am guessing they will backfill Atlanta.

It would seem we have until Oct 1 to really figure it out. Since the plan is constantly changing (currently getting worse) we and the company probably benefit by being slower to react. Believe it or not, we are the best market in the world, based on the current (3/30) schedule load. China tried to rebound, then sank again by 5% last week.

Usually, the industry follows GDP pretty closely. This may be considerably different. I am still hanging on to Ed's prognosis of an airline that is 70% of what Delta was, but that is appearing to be optimistic. If we are 65%, that is the size of Delta before the NWA merger.

What is going to be curious is what the bottom looks like without many T Tails in the fleet. I am guessing they will backfill Atlanta.

Last edited by Bucking Bar; 04-03-2020 at 09:58 AM.

#47

Gets Weekends Off

Joined APC: Jul 2010

Position: window seat

Posts: 12,522

Whatever the "percentage of peak Delta" we end up being, my bigger concern is how will that compare to the "peak brand X" percentage. Will we enter a hellscape far worse than post 9-11 of (mostly) radically unsustainable pump and dump start ups where all the industry refugees race to in order to "pay for seniority" with $75 mainline captains and $40 FO's? Or will there be a defacto moratorium due to the pritorization of preservation of capital on the traditional B-School genius version of labor reset arbitrage?

If everyone is 65% of their original because returned demand gets to that point, that's one thing. But its hard to see there not being at least some winners and losers in all of this. So where will DL be on that spectrum? Supposedly we are super well positioned (relatively speaking) and have the greatest team of airline managers the world has ever assembled. Right?

So whatever our "post Covid world" ends up looking like, where will DL be, not relative to DL today, but relative to everyone else?

#48

Gets Weekends Off

Joined APC: Apr 2018

Posts: 3,191

That OAG chart is actually comforting(sarcasm emojii). The USofA is only down 23% on flights flown as of 4 days ago. Course, PAX are prolly down 90%. Combine those two "factoids/suppositions" and that is scary as he[[. USA flights with a high completion rate equals higher costs.....PAX at 10% is a paltry revenue projection.

I had a ticket on AA that was $740 RT bought 3 weeks ago for late summer. They changed one of the legs by greater than 2 hrs. That qualifies for a refund. Took that and then re-booked the same RT as what I got the refund for at $330. So, even if peeps are flying at 10% capacity they might be paying as little as 50 cents on the dollar

IOW, from my view, all that looks really bad

I had a ticket on AA that was $740 RT bought 3 weeks ago for late summer. They changed one of the legs by greater than 2 hrs. That qualifies for a refund. Took that and then re-booked the same RT as what I got the refund for at $330. So, even if peeps are flying at 10% capacity they might be paying as little as 50 cents on the dollar

IOW, from my view, all that looks really bad

#49

The same people that say this...

We're too vital to the US/world economy, we'll never be released by the government (NMB) to self help...or the President will order us back to work! PEB!!!!! Congress will impose a contract!

Also say this...

If we kept money on hand, we'd be hostilely taken over, money/assets raided, company left in shambles and we will fail.

We're too vital to the US/world economy, we'll never be released by the government (NMB) to self help...or the President will order us back to work! PEB!!!!! Congress will impose a contract!

Also say this...

If we kept money on hand, we'd be hostilely taken over, money/assets raided, company left in shambles and we will fail.

#50

Line Holder

Joined APC: Mar 2019

Posts: 52

Corporate raiders are going to be left holding the bags of billions of $ in aluminum tubes and no buyers in a distressed industry and global economy. I donít think all these ďassetsĒ are very appetizing to liquidate right now.

Thread

Thread Starter

Forum

Replies

Last Post